can you work part-time when your on social security disability

Yes you can work while receiving Social Security Disability Insurance SSDI benefits but only within strict limits. In answer to your question Social Security does not deduct earnings from your disability benefits.

How Many Hours Can I Work On Ssdi John Foy Associates

For 2017 the income limit is 1170 per month.

. If you work while receiving Social Security Disability Insurance SSDI you must make below a certain amount adjusted according to the years cost of living. This means you would not be entitled to ongoing benefits but you may be eligible for a lump sum payment for the period of time you were actually unable to work. Payments will stop if you are engaged in what Social Security calls substantial gainful activity.

If you intend to work part-time while applying for Social Security disability it is imperative that you keep track of your earnings in the form of your W-2s 1099s or weekly paystubs. Tim Moore is a former Social Security Disability Examiner in North Carolina has been interviewed by the NY. Ad Social Security Disability Insurance Stops If You Earn More Than Certain Monthly Limits.

However there are strict limits as to how much you can work and earn while getting Social Security Disability Insurance SSDI. If you are receiving Supplemental Security Income SSI your income must be below that years. The following describes it.

If you become disabled at the age of 58 you need 36 work credits. SGA as its known is defined in 2022 as earning more than 1350 a month or 2260 if you are blind. You can work and still receive SSI benefit however the SSI benefits are reduced based on the amount you earn.

The SGA for 2018 is set at. And if you cant continue working because of your medical condition your. Once you start receiving benefits the Ticket to Work program offers a transition period in which you may work and earn more than the SGA limit.

Learn exactly what each incentive entails and your rights and responsibilities so that you can keep your benefits while trying to get your footing back in the. Therefore most recipients receive SSDI in place of working. Remember the limit is a gross amount of earnings not a net amount of earnings.

If you become disabled at the age of 48 you need 26 work credits. You can work part time while you apply for Social Security disability benefits as long as your earnings dont exceed a certain amount set by Social Security each year. In this case you can continue working part-time on disability while collecting full benefits as long as your earnings are not considered by the SSA to be substantial.

Once you earn more than the limit Social Security deducts 1 from your benefits for every 2 you earn. If you are currently receiving Supplemental Security Income SSI or Social Security Disability Insurance SSDI benefits you must comply with strict rules regarding your employment. Understanding SSI - SSI Income.

For instance if your employer is giving you special accommodations so that you can work Social Security may subtract the value of these accommodations when it counts your income meaning that you might be able to make somewhat more than 1350 per month. Yes you can work and still receive Social Security disability benefits SSD under the Social Security Administrations work incentive programs. It allows you to work for nine months without losing your SSDI benefits.

The SSA defines Substantial Gainful Activity SGA as any monthly earnings over 1260 except for those who receive disability for vision problems. If you earn more than the SGA limit you will no longer be eligible for benefits. But both SSI and Social Security Disability have rules that govern the treatment of work activity.

Despite the stringent total disability standards applicable to Social Security Disability Insurance SSDI claimants some beneficiaries can work part-time while receiving SSDI benefits. This disability planner page lists some of the circumstances that can change your eligibility for benefits after you start receiving them how often we review your case to check whether you are still disabled the two things that can cause Social Security to decide that you are no longer disabled and what happens if you go back to work while you are receiving benefits. So yes you can work while on social security disability.

Workers Younger than 31. Special rules make it possible for people receiving Social Security disability benefits or Supplemental Security Income SSI payments to work and still receive monthly payments. The number of credits a worker 31 or under needs depends on how old the worker was when the disability started.

Trial Work Period TWP The TWP is part of the Ticket to Work Program. If youre working part-time and are earning more than the maximum amount per month set by the SSA then your eligibility for SS disability benefits could be in jeopardy. It is possible to work part time but this can make it harder to prove you cannot work full time.

You can generally work part-time while you apply for Social Security disability benefits as long as your earnings do not exceed the monetary threshold that the Social Security Administration SSA sets every year. Yes you can work while receiving disability benefits. If you become disabled at the age of 52 you need 30 work credits.

Many beneficiaries dont know about the Social Security Administrations SSA work allowances because the majority of SSDI beneficiaries can no longer work in their usual. But in some cases you may take part in work incentives while receiving the full amount of SSDI. However your monthly earnings may cause your disability benefits to be suspended or even terminated.

Social Securitys work incentives and Ticket to Work program can help. For SSDI you can only receive benefits if you cannot work a full time job or enough to be considered substantial gainful activity 1350 per month 2260 if youre blind. Are You Taking Part in One of Social Securitys Work Incentives Programs.

Yes you are allowed to work if you receive Social Security Disability or receive SSI disability. The SSA wants you to work so the amount of benefits they have to pay out is reduced. In the year you reach full retirement age Social Security becomes more forgiving.

Generally speaking you cannot work while receiving Social Security disability but there are some exceptions. On the other hand if you make minimum wage and are working 25 per week Social Security may use. It is possible to receive Social Security disability benefits if you are working part-time.

1180 per month for non-blind applicants. Basically SSI does not reduce your SSI benefits for the first 65 you earn in a month. Based on this you would think that working part-time while collecting SSDI benefits would be a definite no-no But surprisingly thats not the case.

If you receive Social Security Disability you are allowed to work. You can work part time as long as you are careful to stay below the SGA limit. You must also inform your.

SSA disability isnt the same as receiving workers compensation benefits. Workers comp is typically short-term financial help to cover medical bills and lost wages while recovering from an. If you earn more than this amount called the substantial gainful activity SGA limit Social Security assumes you can do a substantial amount of work and you wont be eligible for disability.

Can you work part time while on Disability. As of 2021 you can earn up to 1310 per month and still receive SSDI. The SSA frequently reviews your SGA to determine if you are meeting their criteria for disability benefits.

The income limit depends on what benefit you are receiving. However there are rules and limits to how much you can earn to continue receiving disability.

How Much You Can Work Depends On Whether You Collect Ssdi Or Social Security Disability Benefits Social Security Benefits Retirement Social Security Disability

Collecting Social Security Long Term Disability Bross Frankel

Ssi Disability Survivor S Benefits Sims 4 Cc Sims 4 Sims Survivor

Things Nobody Tells You About Filing For Disability Benefits Disability Benefit Social Security Disability Benefits Social Security Disability

How To Properly Complete Your Disability Claim Forms Social Security Disability Denied Disability Social Security Benefits

Under Pa Law You Can Receive Workers Comp And Social Security Disabil Social Security Disability Social Security Benefits Social Security Disability Benefits

Information Needed To Apply For Social Security Disability Benefits Social Security Disability Benefits Social Security Disability Social Security Benefits

How To Qualify For Social Security Disability Benefits After A Stroke American Stroke Association

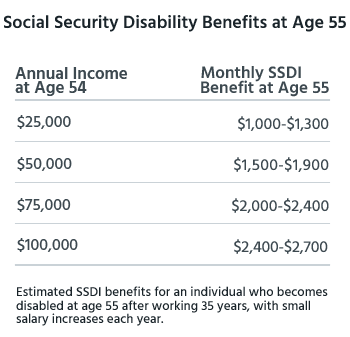

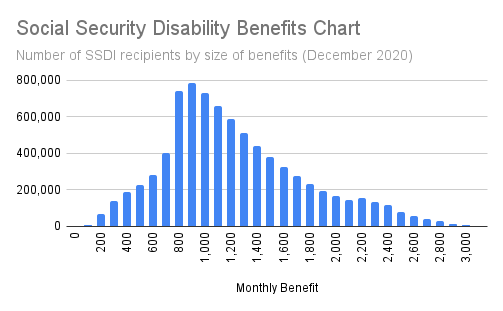

How Much In Social Security Disability Benefits Can You Get Disabilitysecrets

How Much In Social Security Disability Benefits Can You Get Disabilitysecrets

How Much Would You Receive From Disability Benefits Washington Post

Accident Insurance Can Provide Valuable Financial Security Perhaps You Re Self Employed Work Part T Accident Insurance Income Protection Disability Insurance

Top 5 Social Security Disability Application Mistakes To Avoid In 2022 Disability Application Social Security Disability Social Security Disability Benefits

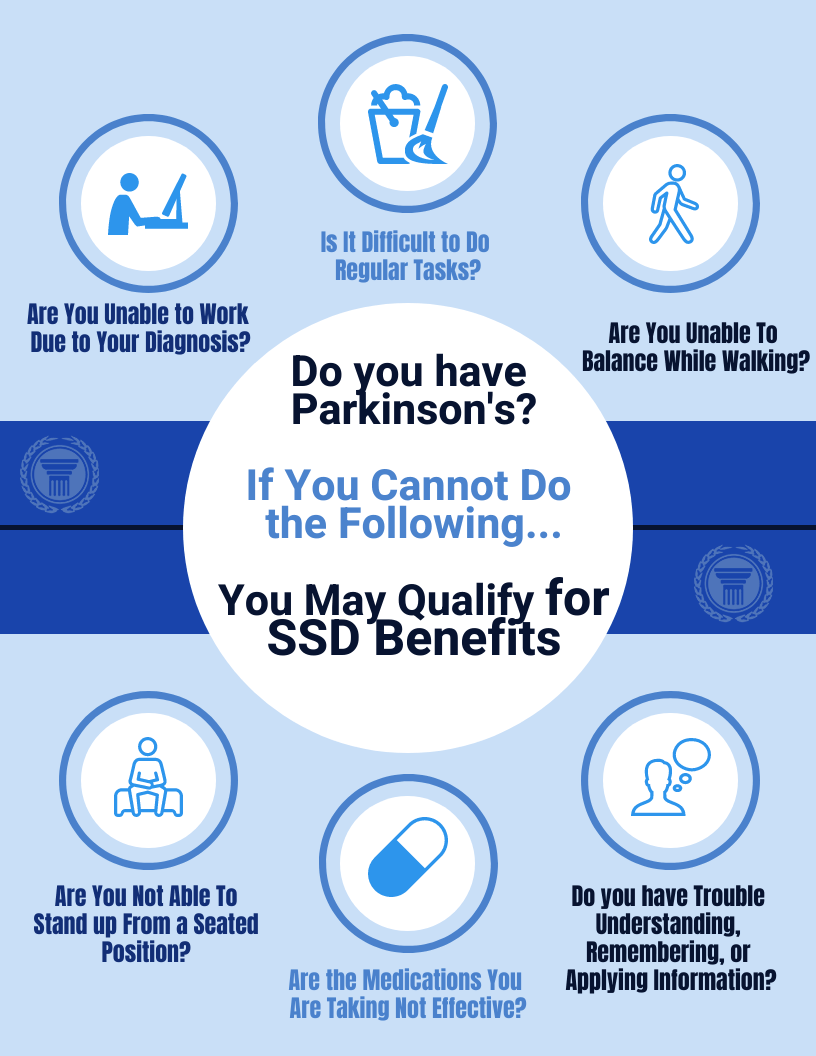

How To Qualify For Disability With Parkinson S Disease In 2022

How A Child With Autism Can Qualify For Disability Benefits Angelsense

It May Prove Worthwhile To Check Out These 7 Little Known Benifits T Social Security Benefits Social Security Disability Benefits Social Security Disability

Medical Records And Why They Matter In A Disability Claim Medical Records Coconut Health Benefits Medical

A Note To Those Who Think Receiving Disability Benefits Means I Have It Easy

60 Day Check In Disability Spoonie Chronicillness Ehlersdanlossyndrome Back To Work Return To Work Get Back To Work